Tds On Job Work For Fy 2019 20 Limit

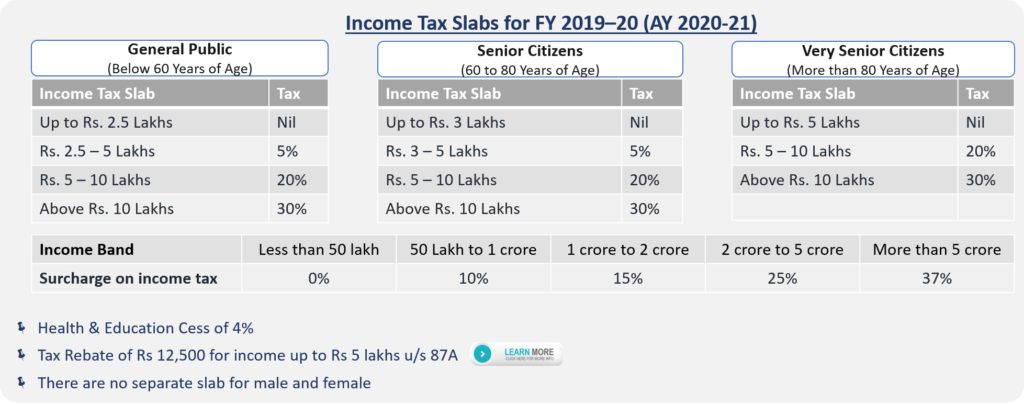

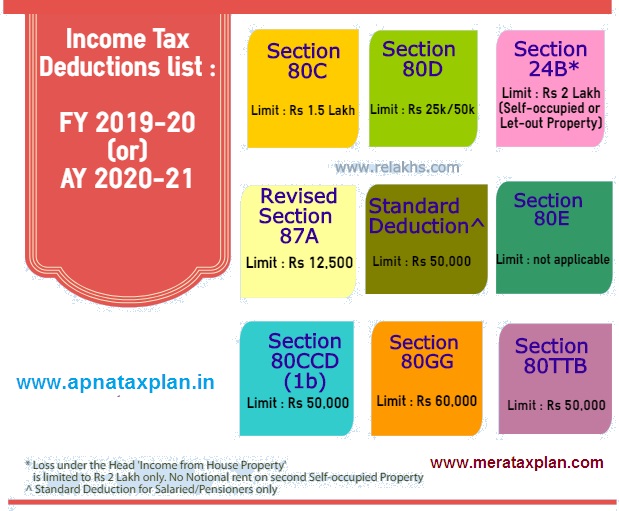

Article takes into account recent changes by interim budget 2019 in tds threshold limits.

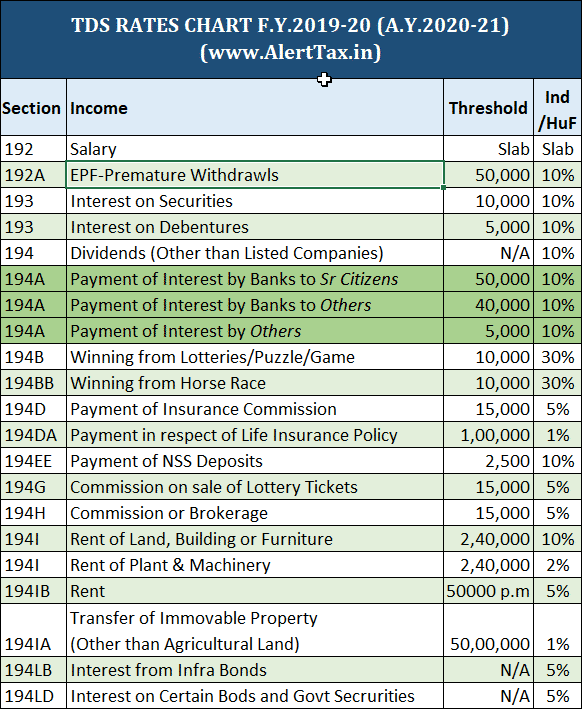

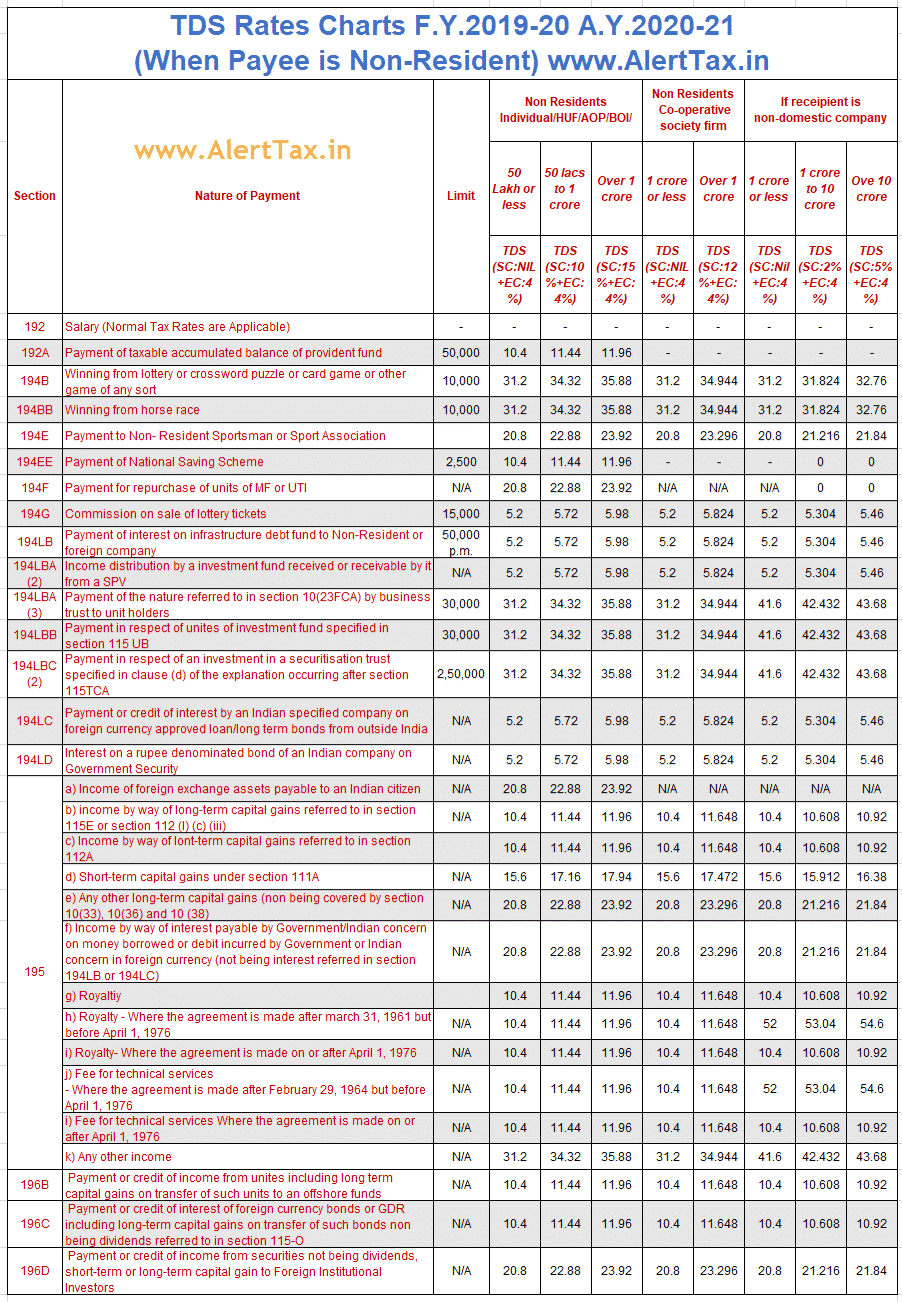

Tds on job work for fy 2019 20 limit. The same rates of tds would apply for both contractors and sub contractors. For your ready reference tds rate chart for fy 2019 20 is provided below. Tds on cold storage 194c clarification no tds on service tax on all section circular 01 2014 dated 13 01 2014 tds on rent various circulars by department on tds on rent e payment of tds mandatory from 01 04 2008. Interest paid by bank co operative bank post office up to 10000.

Tds on job work is required to be deducted under section 194c of income tax act 1961. Rate of tds under section 194c. Tds on job work 194c tds on job work has been relaxed read new definition u s 194c. Threshold limit mentioned in the table below is the limit upto which no tds will be deducted.

Tds shall be deducted following rates u s 194c depending on whether the payee is an individual huf or other than individual huf. Threshold limit for deduction of tax at source under section 194c. Interim budget 2019 has extended the limit of 10 000 to rs 40 000 with effect from f y. 2019 20 ay 2020 21 interim budget 2019 has extended the limit of 10 000 to rs 40 000 with effect from f y.

Rate and amount for deduction of tds. 40 000 in case of payer is bank co operative society and post office. 194a tds on interest income other than on securities. No tds is required to be deducted if.

The rate of tds is as under. Find table below for the tds tax deduction at source rates and threshold limits for financial year 2019 20 or assessment year 2020 21.

.jpg)