Tds Rate On Commission For Ay 2020 21

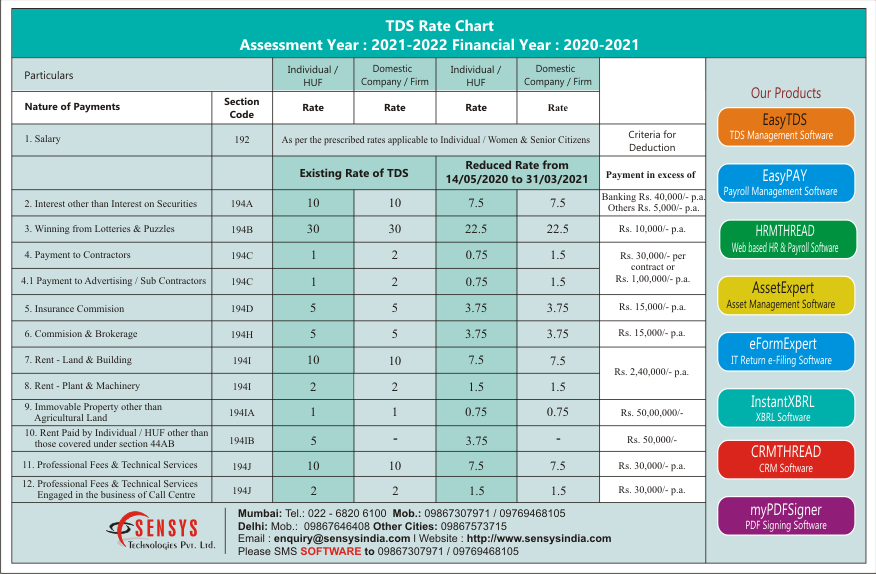

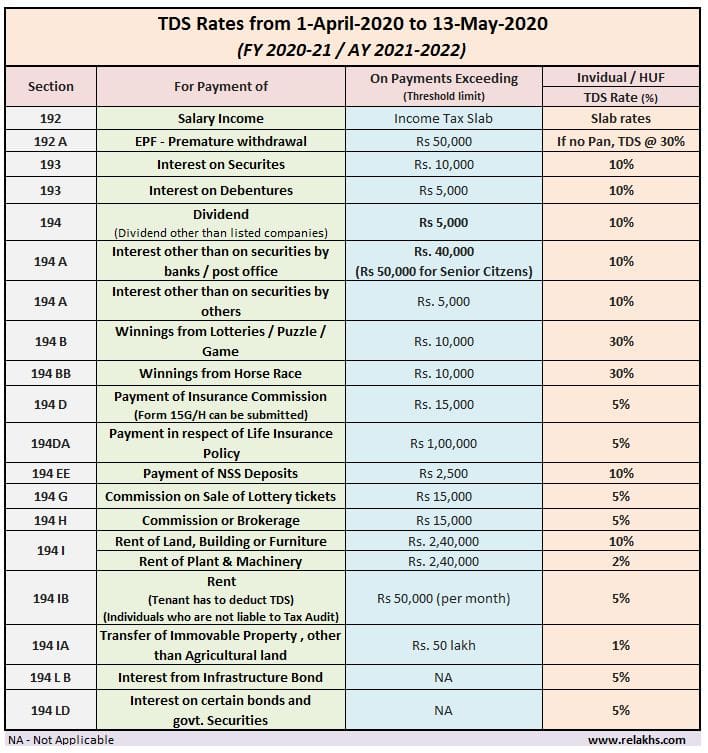

Check out the latest tds rate chart for fy 2020 21 ay 2021 22.

Tds rate on commission for ay 2020 21. Tds rate chart for fy 2020 21. 194d 15 000 00 5 10 20 payment in respect of. A tds of 30 is applicable on it. Latest tds rate chart for nris for ay 2020 21 interest earned on non resident ordinary account nro is taxable.

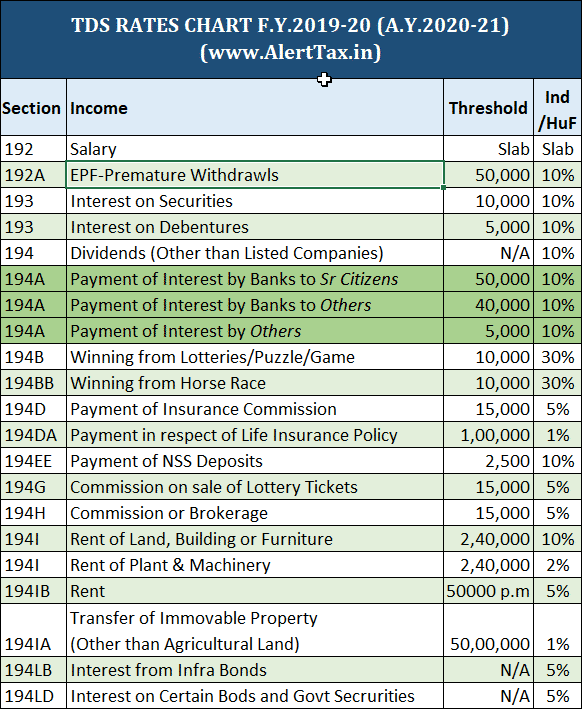

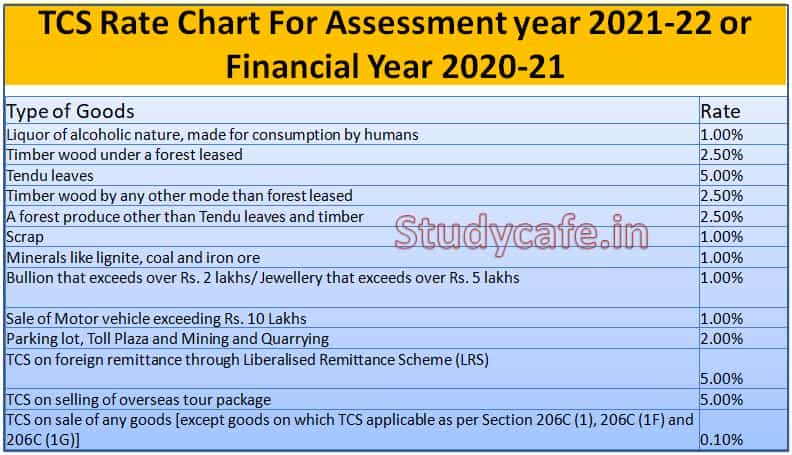

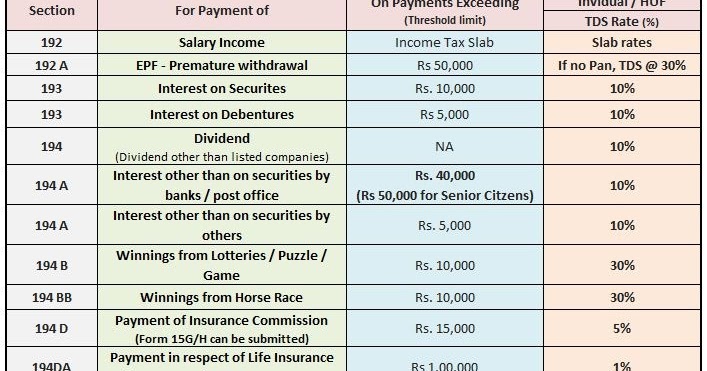

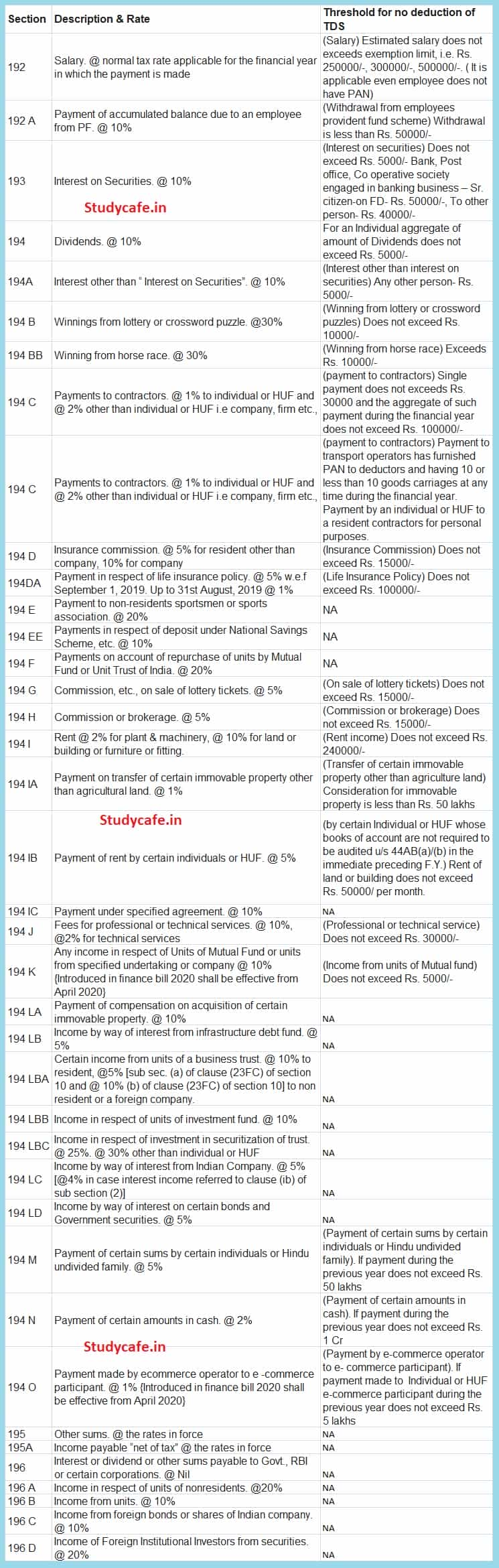

Alcoholic liquor for human consumption. Find table below for the tds tax deduction at source rates and threshold limits for financial year 2019 20 or assessment year 2020 21. But interest earned on non resident external nre accounts and foreign currency non resident fcnr accounts is not taxed in india. Hence here we come up with in depth tds rate chart for assessment year 2021 22 financial year 2020 21 after this amendment.

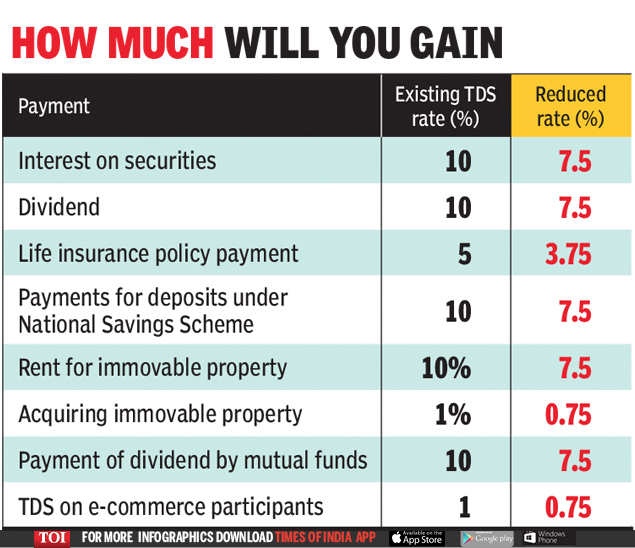

So we have different tds rates up to 14th may 2020 and from 14th may 2020 for the fy 2020 21. Timber obtained under a forest lease or other mode. Tds rate chart up to 14 may 2020. Threshold limit mentioned in the table below is the limit upto which no tds will be deducted.

The tds rate on income depends on the salary of an individual and based on that it ranges between 10 to 30. Below are the latest tds rate table applicable between 1st april and 13th may 2020 of fy 2020 21. Parking lot toll plaza mining and. Tcs rate 206c.

The government has provided relief in the tds rates for the period 14 05 2020 to 31 03 2021. Section 194k and section 194o which provides tds on mutual fund income and tds on e commerce transactions. Tds rate chart for the fy 2019 2020 ay. Owning more than 10 goods carriages 194c 30 000 00 single bill or 75 000 00 aggregate bills during the year.

This article will also cover amendments taken place by finance budget 2020 such as two new tds sections i e. Simple tds rate chart for financial year 2020 21 applicable from 14 th may 2020 kindly note amended rates are been given on the basis of pib notification dated 13 05 2020 and on the date of publication of this post no notification in this regard is been notified by the cbdt. 2020 2021 11 payment to transporter not covered u s. The tds rates to be applicable on income for the current year is updated in the tds rates chart for fy 2020 21.

Section 194k and section 194o for mutual funds income and e commerce transactions. Tds stands for tax deducted at source. Find out the indian tds rate and rates of tds tax deducted at source applicable to resident and non resident indians. 1 2 20 12 payment of insurance commission to agents by insurance company.

Any other forest produce not being a timber or tendu leave.