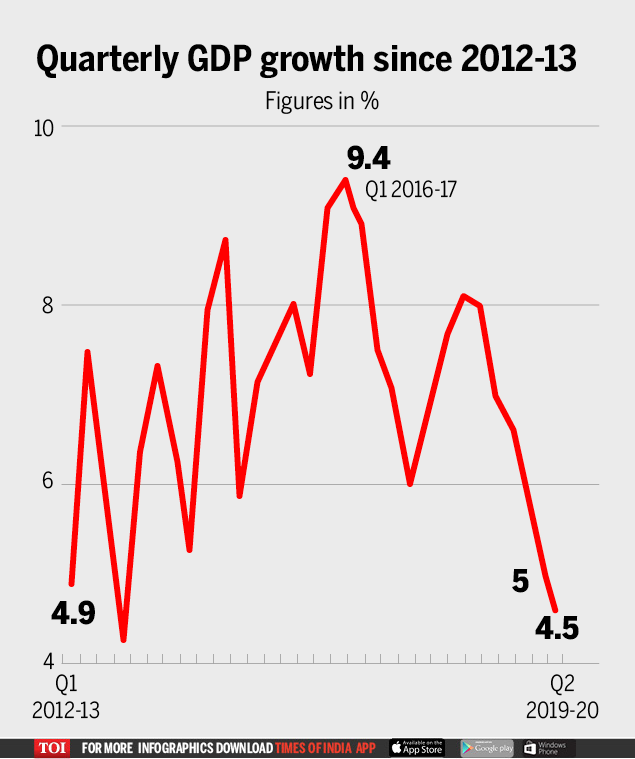

Tds Return Due Date For Fy 2019 20 Q2

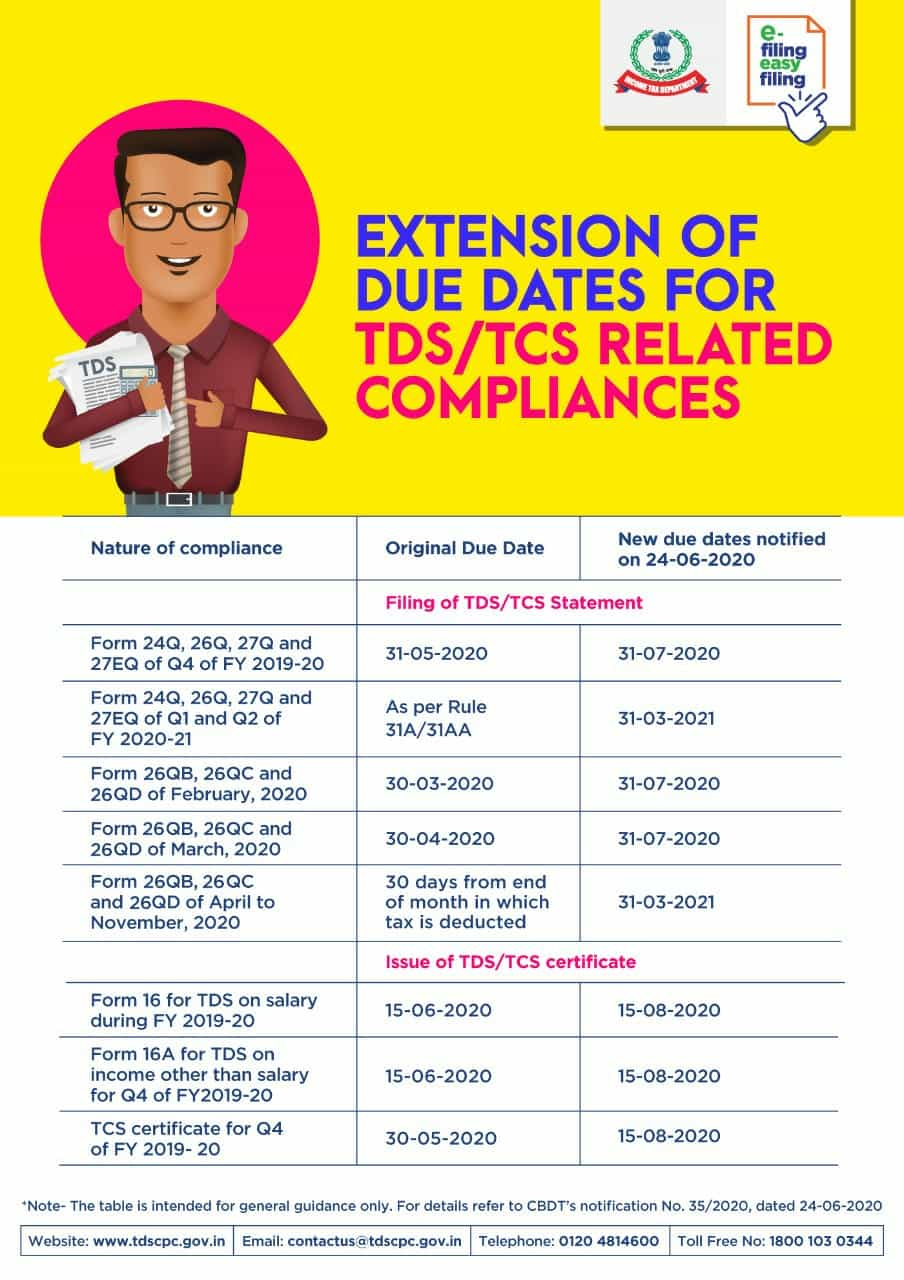

January 4 2018blogs latest update on due dates due date of all income tax returns for fy 2019 20 will be extended from 31st july 2020 31st october 2020 to 30th november 2020 and due date of tax audit will be extended from 30th september 2020 to 31st october 2020.

Tds return due date for fy 2019 20 q2. Form 16 is issued for cumulative period i e. Ask an expert tds. Government provides the reasons behind tds like move on remittances. 2019 20 15th november 2019.

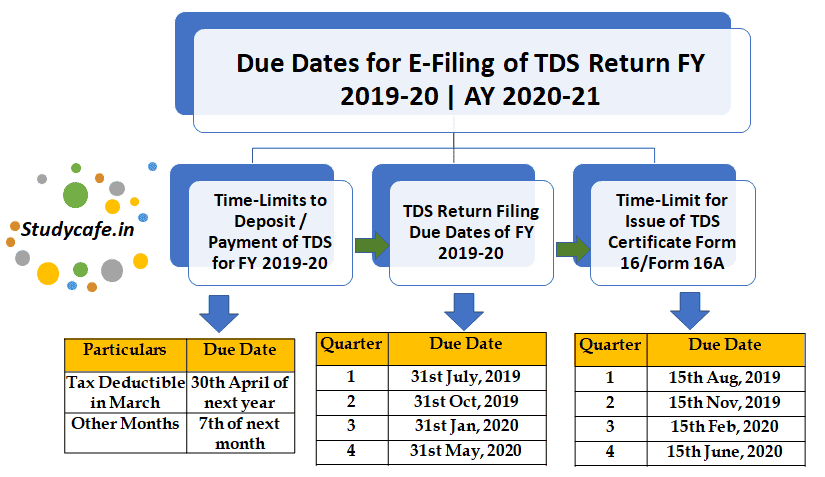

Find tds return due dates and tcs return due dates with the time period and last date for filing for ay 2021 22 fy 2020 21. Due date for issuance of tds certificates for q2 of fy. Delay in requesting certificates may involve a fine of rs. Itr filing due date for ay 2019 20 further extended to 30th sep 2020.

You may also like. 1 st april to 30 th june. Please extend the due dates of financial year 2019 2020 tcs and tds returns upto 30th august 2020 and also extend the time for it returns of 2018 2019. This calendar has been made in line with a tweet made by the income tax department.

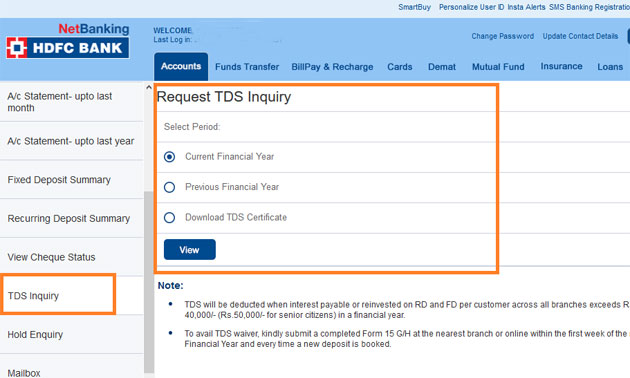

Tds stands for tax deduction at source while the tcs stands for tax collected at source. Latest update on tds provisions due to covid 19. The interest rate for a delay in the deposit of tds has also been reduced from 18 to 9. Interest on late payment of tds note.

As per the income tax act if any person makes a payment to the receiver then tds is required to be deducted at a prescribed rate and then deposited with the government. 1 st january to 31 th march. Amid the corona virus pandemic the income tax departmenthas issued a statement to clarify that the tds return due date for q1 and q2 for fy 2020 21 is 31st of march 2021. The above interest should be paid before filing of tds return.

Quarter period tds return due date. Under section 201 1a for late deposit of tds after deduction you have to pay interest. 1 st july to 30 th september. 1st april to 30th june and therefore due date for issuing form 16 for fy 19 20 would be 15th june 2020.

100 per day u s 272 a g subject to an upper limit of the tax deducted. The government has extended the last date to file it returns for the financial year 2018 2019 to 30 june 2020. 1 st october to 31 th december.