Tds Return Filing Due Date For Fy 2020 21 Extended

These days there is a lot of confusion in reference to the due date of filing tds return for quarter 1 of fy 2020 21.

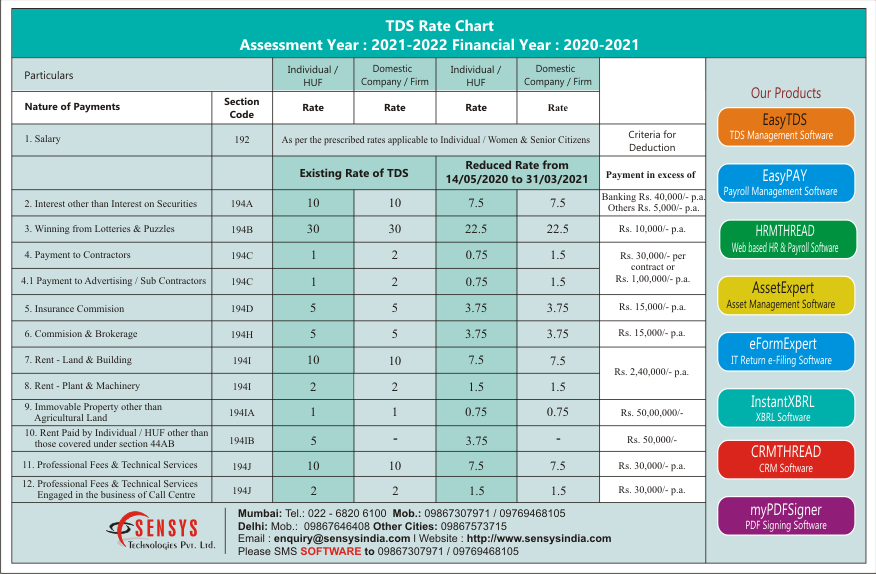

Tds return filing due date for fy 2020 21 extended. Extension of due dates for tds tcs related compliances. Form 24q 26q 27q and 27eq of q4 of fy 2019 20. New due dates notified on 24 06 2020. Quarterly tds certificate in respect of tax deducted for payments other than salary for the quarter ending september 30 2020.

15 th november 2020. The government has extended the last date to file it returns for the financial year 2018 2019 to 30 june 2020. Due dates as prescribed in the income tax act is given below. Filing of tds tcs statement.

Let us understand has the due date been extended or it is 31st july 2020 as per rule 31a. The interest rate for a delay in the deposit of tds has also been reduced from 18 to 9. Form 24q 24q 26q 27q and 27eq of q1 and q2 of fy 2020 21. 370142 23 2020 tpl dated 24th june 2020 issued by govt of india the due date for filing of tds tcs return for q1 q 2 of fy 2020 21 is 31st march 2021.

Government provides the reasons behind tds like move on remittances. It may be noted that as per the normal provisions ignoring above ordinance amendment thereto the due date to furnish the quarterly tds statement for the first quarter ended on 30 th june 2020 for the fy 2020 21 is 31st july 2021. Ordinance 2020 extended the due dates of all compliances falling in between 20 th march 2020 and 29 th june 2020 to 30 th june 2020. As per notification no 35 2020 f.

As per the normal provisions the due date to furnish the quarterly tds statement for the first quarter ended on 30 th june 2020 for the fy 2020 21 is 31 st july 2021. Tcs last dates of fy 2020 21 for return filing.