Tds Return Filing Due Date For June 2020 Extended

Saxena files the tds return for the first quarter of 2019 2020 on april 4 2020.

Tds return filing due date for june 2020 extended. Government provides the reasons behind tds like move on remittances. Introduction of section 87a income tax rebate. Tds during the quarter amounted to rs. Now in this case the due date to file tds return for the first quarter of fy 2019 2020 april 2019 june 2019 is july 31 2019.

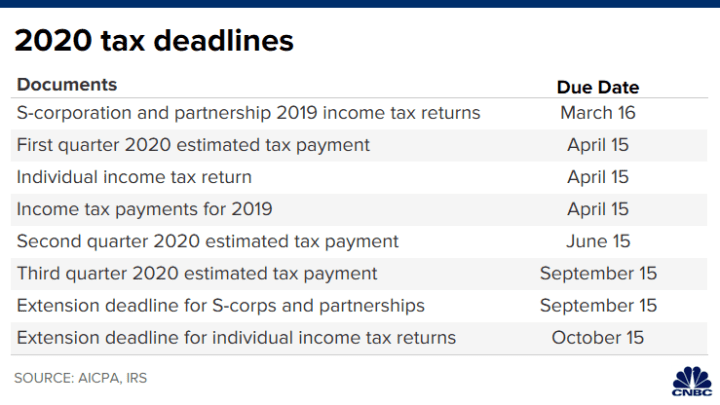

Consequences of tds defaults. All the due dates prescribed or notified under the income tax act which fall during the period from march 20 2020 to june 29 2020 have been extended to june 30 2020. Steps for filing rectification request on receipt of demand notice due to mis match of income tax. In view of the same the timelines to submit the quarterly tds tcs statement has been extended.

No tds on service tax u s 194j of the income tax act. Tds example where penalty is less than tds mr. 35 2020 dated 24 june 2020 on various due dates of compliance under the income tax act 1961. The interest rate for a delay in the deposit of tds has also been reduced from 18 to 9.

Tds tcs rates chart for a y. When the ordinance 2020 was promulgated the specified compliance end period was june 29 2020 and thus the due date for furnishing the tds statements for fy 2020 21 was not of any significance since the first due date for quarter 1 of fy 2020 21 is july 31 2020 which is beyond the end period of june 29 2020. Fees and penalty for late filing of tds returns. 370142 23 2020 tpl dated 24th june 2020 issued by govt of india the due date for filing of tds tcs return for q1 q 2 of fy 2020 21 is 31st march 2021.

The government has extended the last date to file it returns for the financial year 2018 2019 to 30 june 2020. Following are the revise due date relating to tds and tcs related compliances subscribe to whats app updates. As per notification no 35 2020 f. Revised due dates relating to tds tax deducted at source compliance as per notification 24 june 2020 the recent cbdt s notification no.

/income-tax-deadlines-3192862-final-d831a609c81b47ce947c2d53616a0ba9.jpg)