Tds Return Form 26qb Related To

Filling of other tds statements form 26qb 26qc 26qd form 26qb 26qc and 26qd of february 2020.

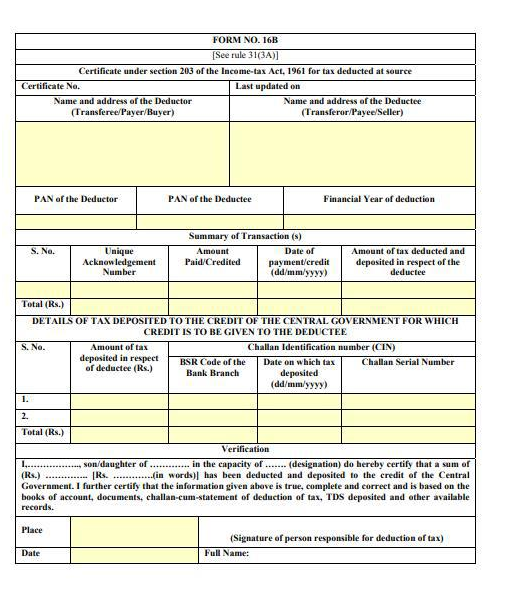

Tds return form 26qb related to. Form 26qb is a return cum challan form for the payment of tax deducted at source tds to the government for deductions made under section 194 ia of the income tax act 1961. Quarterly statement for tax deducted at source in respect of all payments except salaries. As per cbdt notification henceforth all persons who have to deduct tax u s 194m have to furnish a tds certificate in the form 16d to the payee within 15 days from the due date for tds return filing in form 26qd. 30 days from end of month in which tax is deducted.

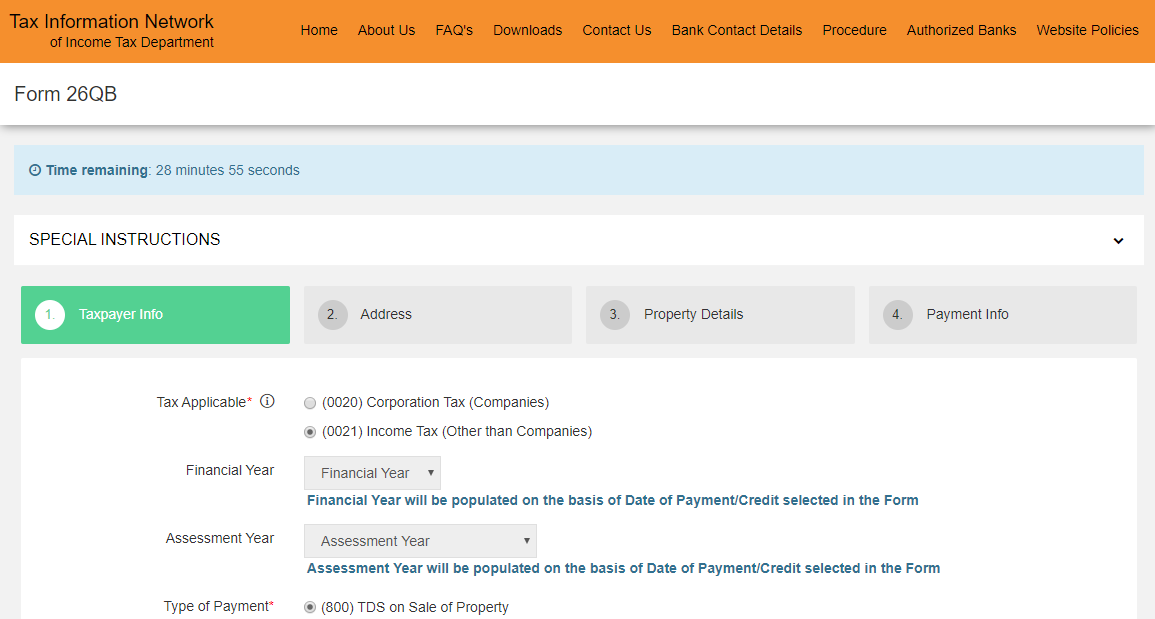

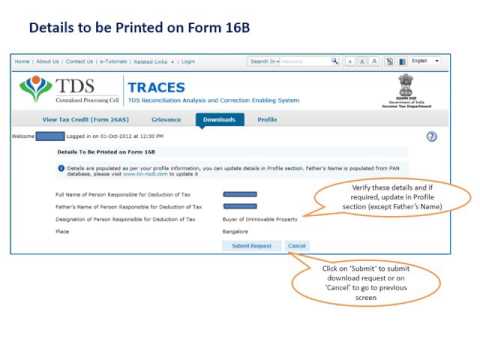

The deductor i e the purchaser of property has to file form 26qb which is a challan cum declaration statement within 30 days from the end of the month in which payment is made. Statement for tax deduction on income received from interest dividends or any other sum payable to non residents. Accordingly the taxpayers are required to furnish the aforesaid new tds return filing forms. Form 26qb 26qc and 26qd of march 2020.

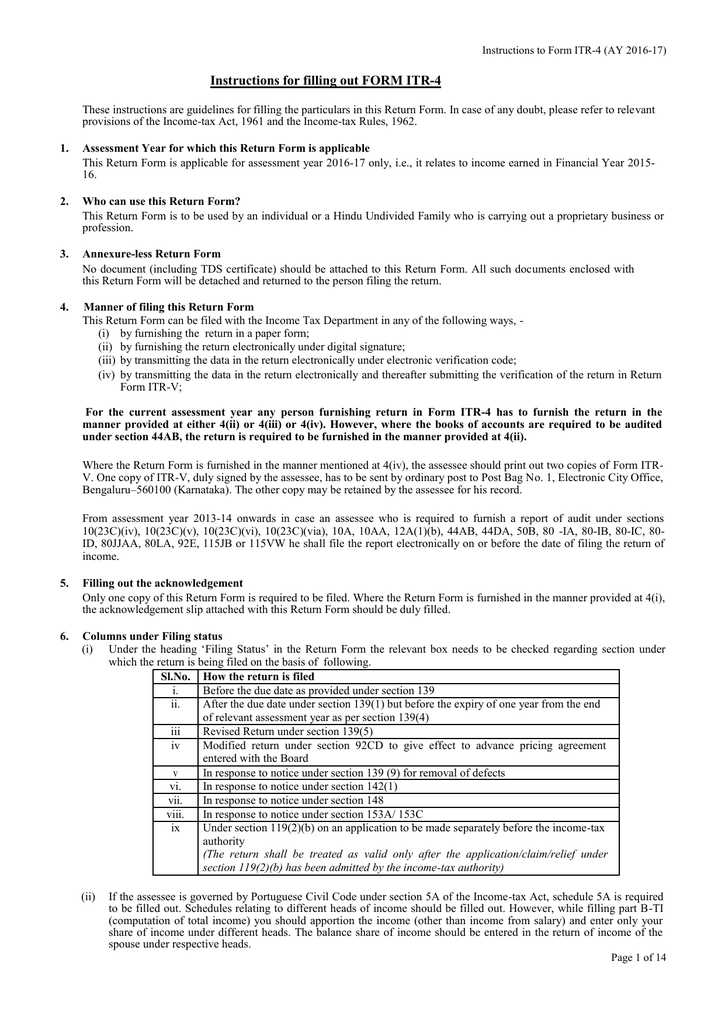

Statement for tax deducted at source from salaries. Due date of tds payment and form 26qb. Fill the complete form as applicable. Quarterly statement of deduction of tax from interest dividend or other sum payable to non residents.

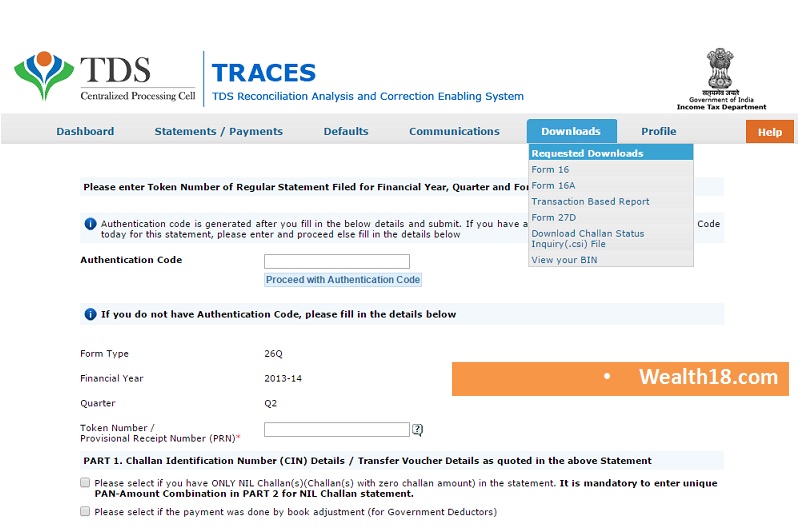

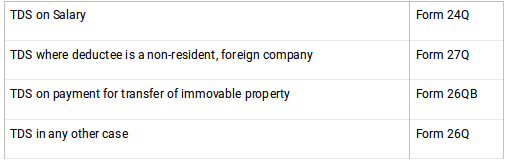

No separate tds return is to be filed in respect of such deduction. Particulars of the tds return forms. Statement for tax deducted at source on all payments other than salaries. Type of tds return forms.

User should be ready with the following information while filling the form 26qb. Form 16d is the tds certificate for tds payment u s 194m. What is form 16d. All software tools for tds tcs need to follow this data structure while providing the tds tcs related information for the e return.

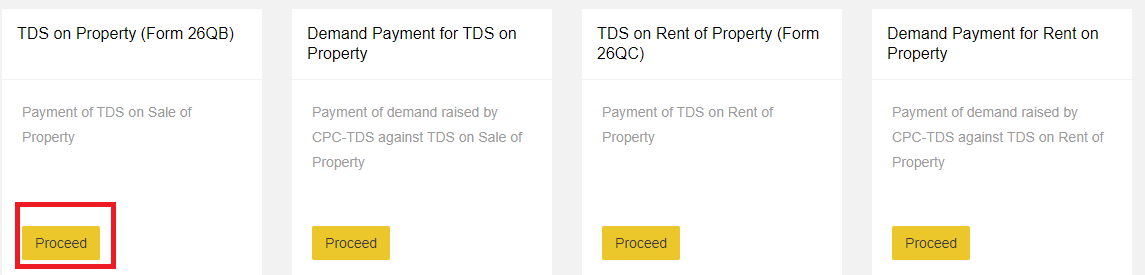

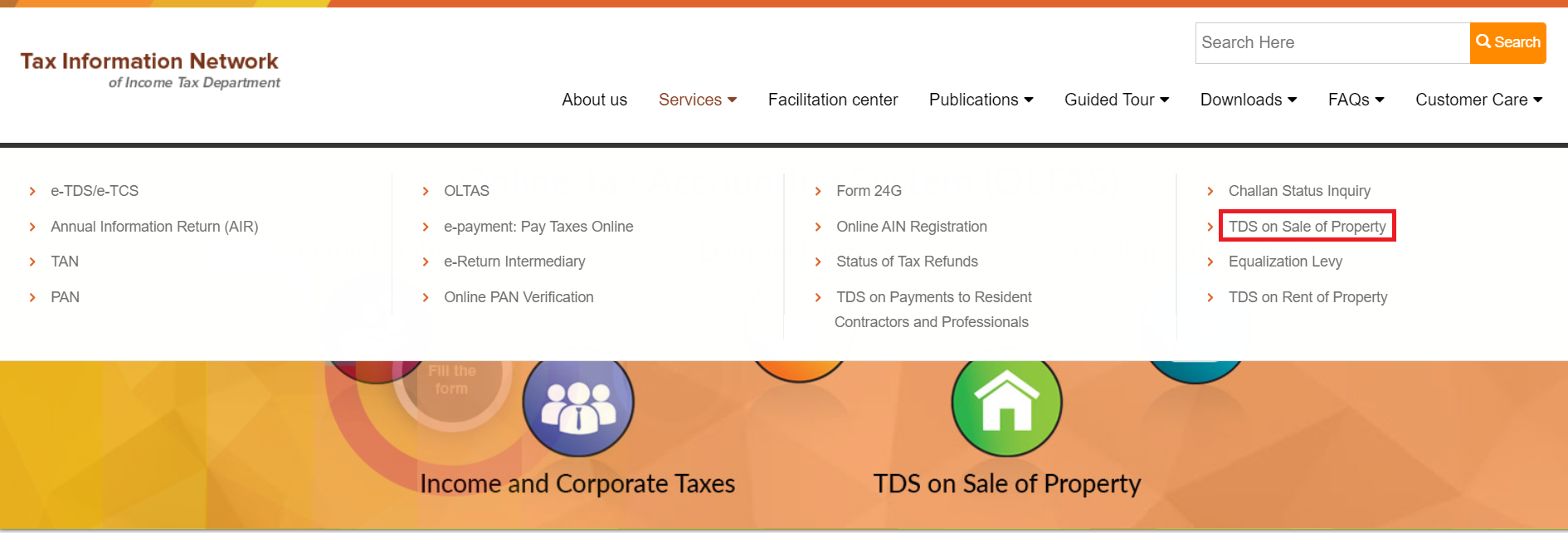

Due date of tds tcs related compliances were extended by cbdt on 24 06 2020 vide cbdt s notification no. It is a challan cum statement of deduction of tax u s 194 ia. Under tds on sale of property click on online form for furnishing tds on property form 26qb or click here select the applicable challan as tds on sale of property. Form 26qb 26qc and 26qd of april to november 2020.